In our recently released whitepaper, The Give and The Get: The Future of Philanthropy, we noted that many nonprofits are now investing funds in a way that promotes equity. These investments are made with the intent to generate a measurable, beneficial social or environmental impact alongside a financial return. Of our survey respondents, 23% invest all or part of their funds under impact investing guidelines, so we decided it was time to explore this further by asking the following questions:

How to Make a Return on Your Investment Portfolio While Supporting Your Community

Is it possible to invest in a way that would bring great market returns but also further the mission of a nonprofit organization? How can nonprofits use their investment portfolio as an active tool to promote their cause? Are there any strategies that will go beyond grants in creating a community impact?

The traditional approach to managing nonprofit investment portfolios has long been focused on earning market returns to generate funds for grant-making and operations while maintaining or growing the investments balance. A fairly new way to invest called mission related investing is generating a lot of interest, especially in the private foundation sector. Mission related investing emphasizes targeting potential investments based on their society impact and ranges from avoiding investing in certain industries to seeking investments in social cause enterprises. We sat down with Tatijana Janko and Anna McGibbons from Angeles Investment Advisors to help understand all the different options available.

- How can nonprofit organizations fulfill their mission using their investment portfolios?

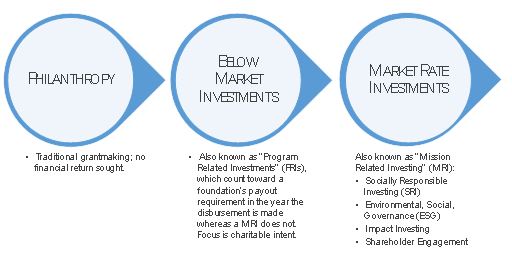

There are three primary strategies for non-profit institutions to consider in pursuit of a socially responsible investment approach:

Non-profits’ grantmaking is widely understood so we will move on to below market rate and market rate investment strategies. These strategies can be used by institutions that seek to align their investment and grantmaking strategies to further advance their missions.

Below market rate investments are concessionary investments, typically in the form of direct loans made at terms more favorable than the borrower could otherwise secure, where the focus is on the charitable intent. Private foundations can consider these investments “program related investments” (PRIs), which count toward the foundation’s 5% payout requirement in the year the loan disbursement is made. These investments are expected to be repaid, often with a modest, risk-adjusted return (interest rate on the loan), and proceeds from repayments and interest can be recycled into further PRI activity. PRIs are investments for which the primary purpose is to accomplish one or more of a foundation's tax-exempt purposes; production of income or appreciation of property is not a significant purpose.

Mission related investments (MRIs) are investments expected to have an impact on the institution’s mission, including social or environmental factors, while earning a return that is comparable to market returns. There are several options for institutions that wish to pursue an MRI strategy.

- It is easy to understand shareholder activism, but few nonprofits take that approach because of various tax and other limitations. Could you provide more details of the other three strategies?

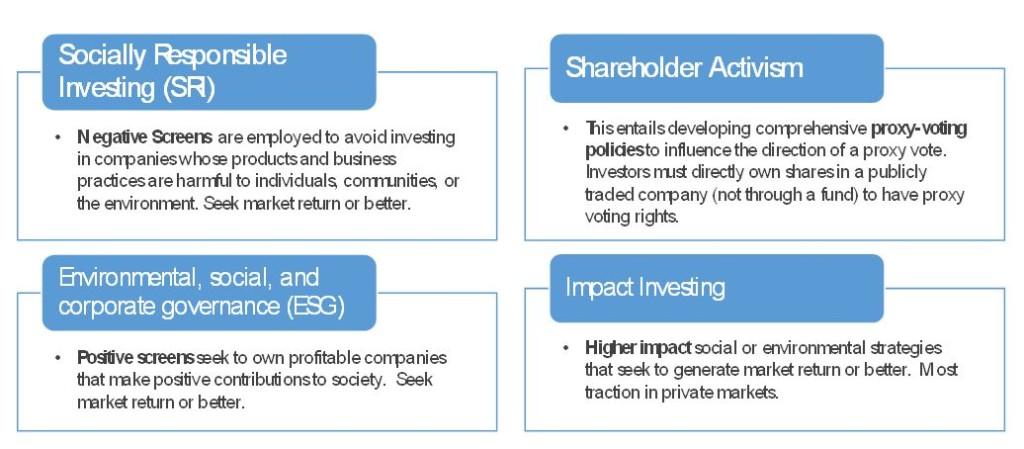

- Socially responsible investing (SRI) in its oldest, most traditional, form refers to use of negative screens to avoid investing in companies whose products and business practices are viewed as harmful to individuals, communities, or the environment (e.g., tobacco, firearms, environmental pollutions, etc.).

- Starting in the early 2000s, “ESG” (environment, social, and governance) factors gained more traction. ESG factors are non-financial factors that some investors believe can have a material financial impact on corporate behavior and returns. Socially responsible investing continues to evolve with more investors today interested in providing direct capital for investments in both companies and entities that follow ESG (environmental, social and governance) best practices and seek positive social change. Examples of “buy” lists may include enterprises with constructive employer/employee relations, strong environmental practices, safe products, and operations that respect human rights globally.

- “Impact investing” is a development in the socially responsible landscape that is also gaining traction. Impact investors have embraced strategies that seek higher social or environment impact and tend to be more closely aligned to the institution’s social mission. Impact investments are investments made into companies and funds with the objective of generating social and/or environmental impact along with a financial return. Most impact investing is in the realm of private investments as venture capital is a natural source of capital for new businesses focused on renewable energy and new technologies.

We refer to these three strategies, SRI, ESG, and Impact Investing, as approaches along the continuum of mission-related investing (MRI) as they all seek to maintain market rate returns while also providing some level of social benefit.

- What is the return on mission related investments as opposed to regular investment strategies?

The expectation is that MRIs will earn a return that is comparable to market returns. Historically, however, the observed net of fee returns of MRI strategies have been mixed. There are varying factors to consider in evaluating track records, including the investment environment during period evaluated, breadth of universe, types of strategies evaluated, and fee levels for MRI/ESG managers.

The impact investing industry is quickly broadening and deepening, but remains in relatively early stages of development, making parsing track records more challenging. As the ESG/MRI investment industry becomes more institutionalized, we are seeing significant activity in the development of benchmarks and more robust reporting of data for impact funds. Institutional private impact funds with meaningful (e.g., largely realized) track records are currently limited.

We believe manager research is a core competency of Angeles Investment Advisors. Our goal is to identify the rare exceptional investment firms for our clients and to know these firms comprehensively. Manager selection is critical to the investment process given the wide dispersion of performance results that we have observed between top managers and median managers, especially in alternative asset classes, over time.

- Why should nonprofits consider implementing some mission related investing strategies?

Non-profits may want to consider implementing certain MRI strategies to structure their investment programs to be in harmony with their social mission without theoretically sacrificing financial return.

- Are there any downfalls of pursuing MRI strategies?

As in traditional investing, manager selection is critical to success in this market segment. There are managers and strategies across the SRI, ESG, and impact investing spectrum that have been successful from a performance standpoint, but there may be access challenges, such as asset minimums, liquidity concerns, and capacity issues. In addition, these strategies have tended historically to be offered with premium fees.

Implementing a social investment agenda could place additional burdens on staff time and some foundations/endowments that are active in this area have hired additional staff to evaluate and monitor investments (especially direct investments). Establishing “social” criteria can be time-consuming for an Investment Committee that meets <6-12 hours per year and it may be difficult for the Committee and Board to agree on SRI/ESG investment criteria.

Finally, measuring impact is difficult and expectations should reflect this.

As mission related investing strategies become more popular, nonprofit organizations have options to help impact the causes they care about. The best approach depends on the goals and funds available to invest, and doing adequate research before investing is critical to success. Selecting an investment manager will also help streamline the investment approach.

Angeles Investment Advisors provides wholly independent investment advice and builds customized investment portfolios for institutions and philanthropic families. Angeles’ investment team shares the structural advantages of sophisticated endowments, integrating robust sourcing of world-class investments with rigorous research and nimble execution. With approximately $27 billion in assets, including $3 billion in discretionary assets the firm’s stability drives lasting partnerships for foundations in the Los Angeles community.

IRS Revenue Code § 4944(c): “Program-related investments must significantly further the foundation’s exempt activities. They must be investments that would not have been made except for their relationship to the exempt purposes. The investments include those made in functionally related activities that are carried on within a larger combination of similar activities related to the exempt purposes and must meet the following legal tests:

- The primary purpose is to accomplish one or more of the foundation’s exempt purposes

- Production of income or appreciation of property is not a significant purpose, and

- Influencing legislation or taking part in political campaigns on behalf of candidates is not a purpose.”