ASC 606 - Revenue from Contract with Customers represents the most significant change in accounting methodology in the past 20 years. The objective of the new guidance is to create and help standardize how revenues are recognized across all industries to improve comparability and transparency. ASC 606 has the potential to significantly impact the way that revenue has been recognized historically, increase disclosure requirements and change the internal tracking and recording of revenues.

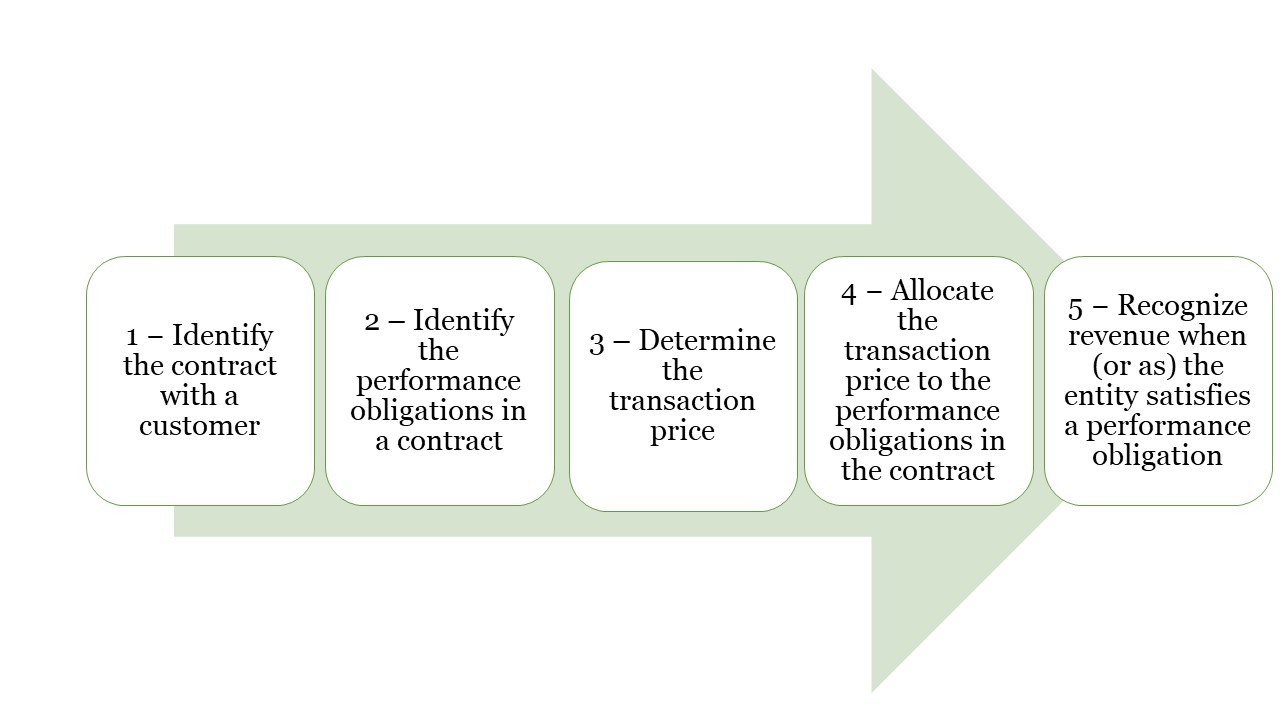

ASC 606 requires that entities analyze revenue streams utilizing the following five-step process:

All of the five steps listed above have the likelihood to impact revenue recognition in entertainment and media companies, specifically in relation to the following areas:

- Step 2: Identifying Performance Obligations: The new revenue recognition model requires that all obligations that are considered “distinct” be accounted for separately, and that the transaction price be allocated based on the relative standalone selling price. As a result of explicit requirements of what is considered “distinct” under the new revenue recognition guidance, there could be significant differences with how contract obligations were identified and how the transaction price was allocated under the previous guidance.

- Step 3: Variable Consideration in Transaction Price: Under the new standard, variable consideration should be estimated and included in the transaction price (Step 3) to the extent that it is probable that a significant subsequent reversal will not occur. Under the current guidance, revenue is deferred until the fee is fixed or determinable and when collection is reasonably assured, which may result in revenues being recognized earlier under the new guidance.

- Licensed Content: Under the new standard, we are required to determine whether the license is classified as functional intellectual property (ie: software, rights to air content, which are recognized at a point in time when the customer has a right to use the license) or symbolic intellectual property (ie: brands, logos, etc. which are recognized over time). Prior to the implementation of the new standard, there was industry-specific guidance that required revenue to be recorded only when intellectual property was complete, delivered, the fee was fixed/determinable, collection is assured and the license period has begun. The overall impact could result in bifurcation of types of intellectual property and a difference in whether revenues may be recorded at a “point in time” with a potential to advance revenue recognition or “over-time,” which may be consistent with previous treatment.

At GHJ, we are here to help you and your company navigate the complexities of the implementation of this new standard and with determining the impact to your year-end reporting to the users of your financial statements. To help clear up the confusion and learn the details of this new standard, contact Dan Landes at 310.873.6705.