As of today, the Federal Open Market Committee (FOMC) has raised target interest rates five times since the beginning of 2022, and it is likely that more increases are on the horizon to curtail inflation.

The target interest rate is FOMC’s suggested interest rate when banks borrow and lend their excess reserves to each other overnight. These rates have a significant impact on the overall economy.

Recent GHJ blogs have covered rising interest rates and the effects of inflation. This blog will explore the relationship between interest rates with the overall mergers and acquisition (M&A) activity, according to historical data and industry experts.

HISTORICAL INTEREST RATES

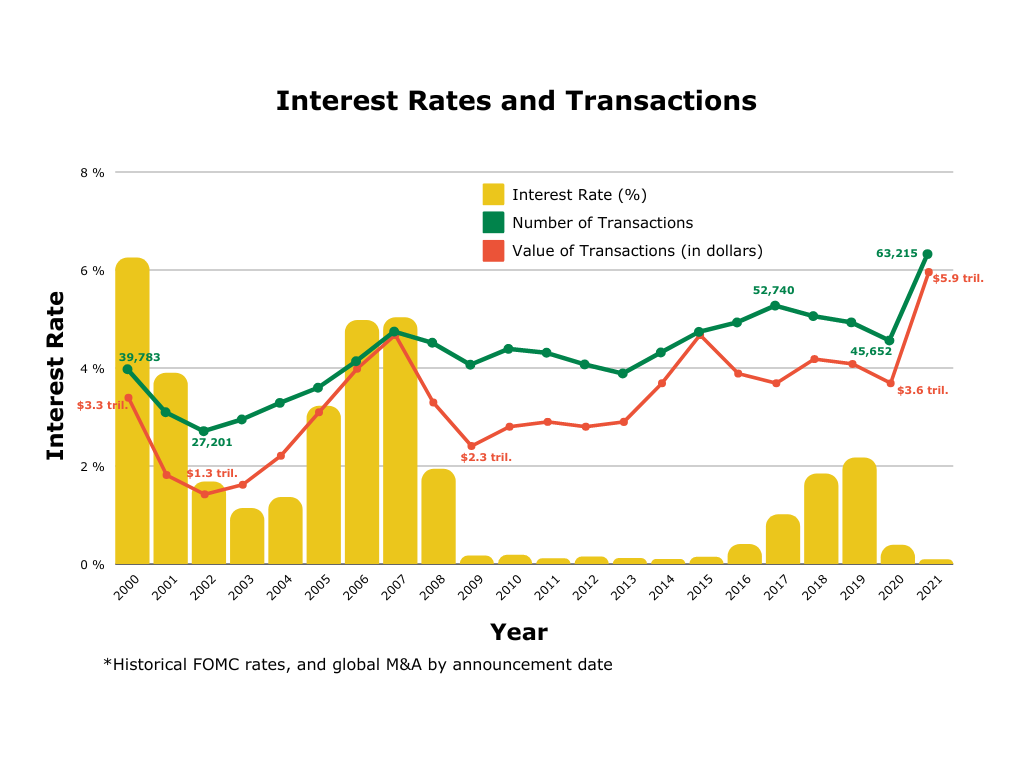

The below graph shows the average federal interest rate as well as the volume and value of global M&A activity for the past 20 years:

At the outset, overall M&A activity appears to be more akin to general economic conditions and other external factors than interest rates. For example, M&A activity was low after the dot-com bubble burst in 2000 and gradually picked back up until the 2008 financial crisis. After the recession, M&A activity gradually built up again until the 2020 pandemic and, after a slowdown, 2021 was a record-setting year.

Although there does not appear to be a strong direct correlation between interest rates and overall M&A activity, rising interest rates will inevitably make leveraged buyouts (LBOs) more expensive and may eventually put pressure on deal values. In addition, private equity firms relying on funds from investors will have to compete for such funds since these investors may have attractive alternatives for investment in the era of high interest rates.

INFLATION

As noted earlier, inflation is a major factor for rising interest rates. It is also likely that inflation will have an impact on M&A activity. While the latest U.S. inflation rate (based on the consumer price index) slightly eased to 8.3 percent in August from 8.5 percent in July and 9.1 percent in June, it is still significantly higher than the approximately 1–2 percent that we saw throughout most of the 2010s.

In a typical middle-market transaction, EBITDA (earnings before interest, taxes depreciation and amortization) is often used as a starting point for deal valuation. If a company is faced with a high inflationary environment and cannot pass on all of the increased costs to its customers, the company’s EBITDA will likely decrease in the future. While those that are negatively impacted may use “normalized” EBITDA to argue for higher valuation, whether a buyer will accept such normalized EBITDA often comes down to who has more leverage in deal negotiation.

In addition, increased costs of money, as well as inflation, will impact the decision-making process for all parties involved. This should have a more pronounced effect on private equity investors in the LBO space. Depending on such private equity investors’ risk tolerances, they may be more prudent in executing transactions. At the same time, there will be buyers who will seek for opportunistic transactions. As a result, transactions are likely to take longer to consummate, and there may be “bargain” deals that were rare in the past few years.

HEAR FROM THE EXPERTS

Given the overall increases in interest rates and inflation along with other external factors, we spoke to a few professionals deeply involved in middle-market M&A to gain their insights on where the market is headed:

- Stanley Huang, Managing Director at Atar Capital, which specializes in complex corporate carve-outs and under-performing businesses.

- Andy Schwartz, Managing Director, and Leon Vayntraub, Director at Raymond James, a global financial services firm. Schwartz and Vayntraub specialize in the commercial and industrial services industry.

How do you think rising interest rates and inflation will impact the M&A market?

Stanley Huang: Higher interest rates will mean a higher cost of capital. From a debt/leverage standpoint, higher rates may cause a half- or full-turn reduction in valuations simply due to the fact that more of a business’ cash flow will be needed to service any outstanding debt. From an inflation standpoint, to the extent a business can pass on the price increases and not have margin contraction, those businesses will be more valuable compared to businesses that experience margin compression due to the fact that they had to absorb the rise in input costs.

Andy Schwartz and Leon Vayntraub: Rising interest rates translate to higher financing costs for acquirers, eating into equity returns, which could theoretically lead to lower transaction valuations. We have not found this dynamic as pronounced in transactions with high-growth companies, where buyers may not look to maximize leverage in order to preserve flexibility. In addition, timelines for value creation plans (including buy-and-build strategies that historically have been funded primarily with debt in the middle market) will need to accelerate as well to achieve target internal rates of return (IRRs), which could lead to marginally shorter hold periods on average. Inflation has many indirect impacts beyond increasing interest rates, such as increasing company product/service pricing. Those that are unable to raise prices in excess of input costs (e.g., labor and materials) will see margin degradation, which could impact both credit quality and valuations.

What are some of the opportunities and challenges you see as a result of interest rates and inflation?

Stanley Huang: We feel that the current monetary tightening bias creates opportunities in the marketplace to pick up assets with more attractive multiples compared to more recent years where valuations have been lofty. From a challenge perspective, rising input costs will mean companies must either (1) pass on these increases to maintain margin or (2) find ways to be more efficient/productive, which may mean that automation and software companies may do quite well in this environment.

Andy Schwartz and Leon Vayntraub: Rising interest rates and inflation will create a larger valuation gap between (1) companies with superior differentiation and competitive positions and (2) those companies that provide more commoditized offerings. More defensive industries should benefit overall from a “flight to quality” — those industries that exhibit more resilient margins and unit economics, such as utilities, and utility-like, mission-critical business models, such as water/wastewater, waste services and HVAC maintenance.

SUMMARY

It is highly likely that rising interest rates and inflation will have a significant impact on the overall M&A market. On a positive note, this may come as an opportunity for those who are willing to take risks and invest in the future. In addition, we may expect creative financing structures to ease the burden of the high costs of capital. While the magnitude of such impact remains to be seen, motivated buyers and sellers will come up with a deal structure that is less dependent on interest rates.

If you have any questions or want to discuss how your business can respond to the interest rate increase and other economic changes, please contact GHJ’s Advisory Team.