On Thursday, June 21, the U.S. Supreme Court ruled that out-of-state (i.e., internet) retailers may be required to collect sales taxes in states where they have no physical presence. In the South Dakota v. Wayfair case, the ruling gives states the authority to impose sales tax against these businesses, and the Quill case was deemed incorrect and overruled. Therefore, substantial nexus may be established in states with annual sales of $100,000 or more or 200 or more transactions even if the seller has no physical presence (i.e., employees, offices, or inventory) in the state.

Background of Wayfair

The basis of the decision was the new interpretation of the substantial nexus provisions under the Commerce Clause of the U.S. Constitution. Since the modern economy is heavily engrained with e-commerce transactions, internet retailers can function and be highly profitable in states in which they have customers without being physically present. Now, gross receipts alone may meet the nexus requirements for South Dakota and other states which have enacted an “economic” nexus standard.

Historically, issues arise when unfair competition exists between online and brick-and-mortar retailers. Online retailers essentially allow a discounted product compared to their brick-and-mortar counterparts when sales tax is not charged. This decision now levels the playing field.

The practical concern is that individual customers generally do not self-report use tax, and states need a way to enforce businesses to pay their fair share of taxes. The increase in online sales over the past two decades is estimated to cost state governments between $8 to $33 billion per year (per Sales Tax Report 11-12 and Brief for Petitioner 34-35 of Case No. 17-494) due to uncollected sales and use tax and corresponding loss of state tax revenue. States have aimed to close this loophole by requiring that online sellers collect sales tax in the state if the annual sales into the state exceed a certain dollar threshold or if the number of sales transactions in the state exceed a certain arbitrary number. In light of the Quill case, the physical presence standard that has been in place for many years and the aggressive response by states to impose an “economic” nexus threshold for sales taxes, it was only a matter of time until a case would be determined at the U.S. Supreme Court level. That case was Wayfair.

Important Considerations

In the opinion by Justice Kennedy, the Court maintained the need for a reasonable presence standard (i.e., safe harbor for de minimis activity), which is appropriate for states to prevent undue burdens upon interstate commerce. The results of the case provided acknowledgement of the compliance burden economic nexus rules will place on small businesses and startups, although the Court was satisfied that South Dakota’s standards were reasonable and necessary to preserve fairness in interstate commerce. This ruling is not retroactive, and the Court was clear that anything otherwise would risk double-taxation of the same receipts. In such retroactive applications, the buyer and sellers would be legally liable for collecting and remitting the tax on a transaction.

Looking to the Future

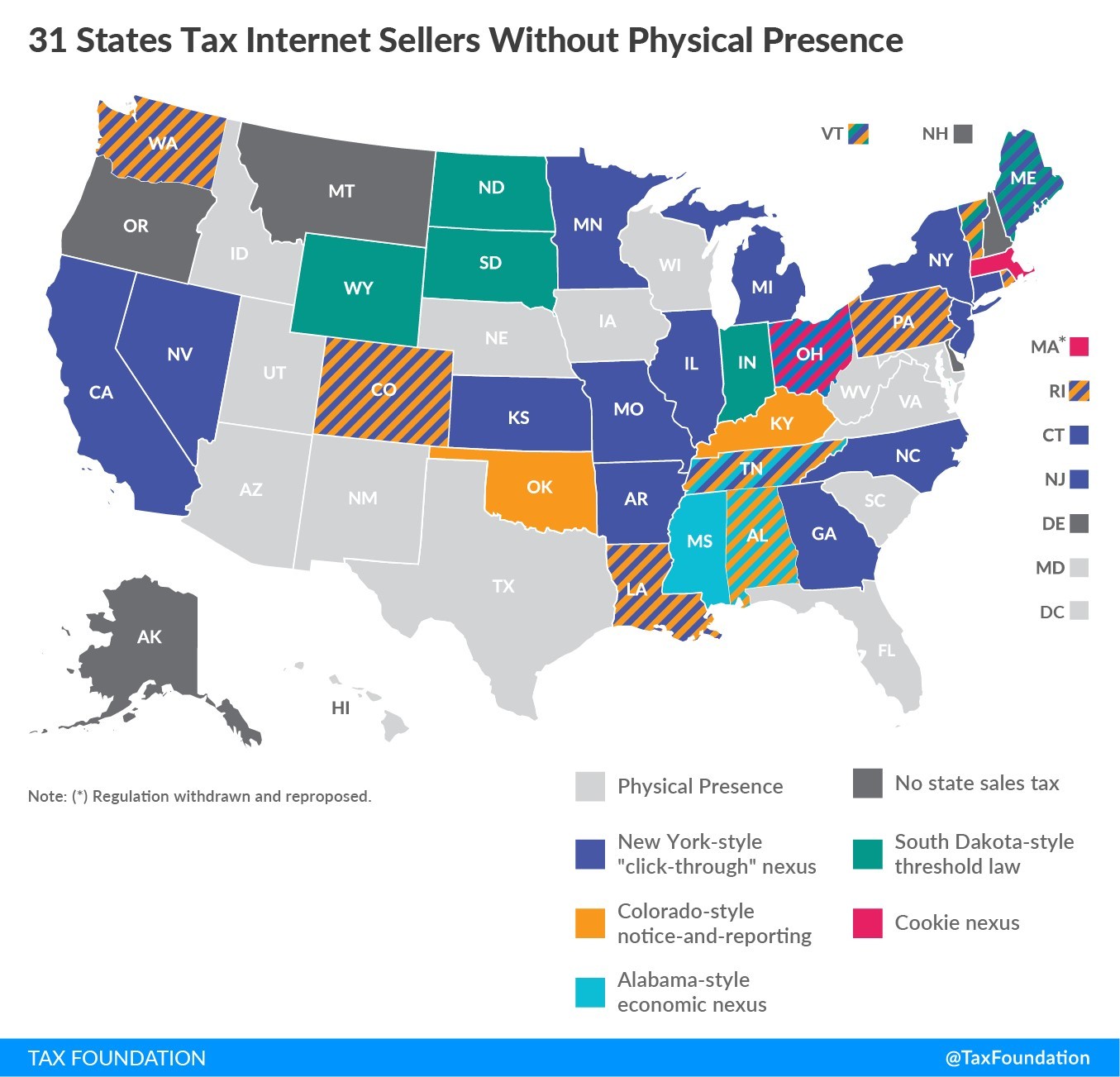

There are currently a number of uncertainties that will be played out over the next few weeks and months. For one, we expect that many states will look to aggressively pass legislation requiring that online retailers collect sales tax on sales to customers in the state. The question will be when these laws are enacted. A reasonable guess would be that a number of states will impose collection requirements immediately (e.g., July 1, 2018), while others may provide some reasonable time (e.g., Jan. 1, 2019) for both the states and companies to determine filing requirements and to put in place the necessary systems to allow for collection and reporting. Several states (i.e., Vermont, Wyoming and others) have pending laws that will be enacted and enforce sales and use taxes on online retailers with the outcome of this case in South Dakota’s favor. One thing is for sure and that is that many online retailers will now find that their sales tax collection and reporting requirements will now be much more complicated and cumbersome.

Below is a chart from the Tax Foundation with a map of current sales tax rules.

As more information becomes available we will provide updates to this tax alert as they occur. If you have any questions regarding the above information and its implications, please reach out to Akash Sehgal or Frances Ellington.