When a foreign investor becomes a U.S. tax resident, one easily overlooked U.S. tax issue is that such residence change may result in an adverse U.S. tax structure, sometimes referred to as a “Sandwich Structure.”

What is a Sandwich Structure?

Let’s use an example to explain what a Sandwich Structure is.

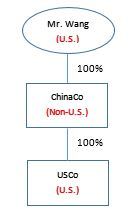

A Chinese tax resident, Mr. Wang, owns a manufacturing company in mainland China that produces computer accessories. To increase the global sales, Mr. Wang travelled a few times to the U.S. and decided to form a U.S. corporation as a marketing and sales arm for the U.S. market. The U.S. corporation (USCo) was structured as a company wholly owned by the Chinese manufacturing company (ChinaCo). The U.S. market expansion, due to the robust demand from U.S. consumers and the fabulous California sunshine, helped Mr. Wang decide to immigrate his entire family to Los Angeles and obtain U.S. green cards. Under U.S. tax rules, Mr. Wang should be treated as a U.S. tax resident after obtaining a U.S. green card. ChinaCo becomes a controlled foreign corporation (CFC) to Mr. Wang, and USCo is treated as an investment in U.S. property by ChinaCo. This is a typical Sandwich Structure: a U.S. person owns a non-U.S. corporation, which in turn owns a U.S. corporation.

See the structure chart below:

Income Tax Consequences of a Sandwich Structure

Once the Sandwich Structure exits, there are certain transactions that could trigger adverse U.S. income tax consequences to Mr. Wang because of the Subpart F income inclusion (IRC section 951). Generally, Subpart F income rules are designed to force inclusion by a U.S. shareholder in a CFC of passive types of income earning by the foreign corporation, regardless of whether the income was distributed. Subpart F income also includes certain types of transactions which are treated as deemed repatriation of earnings (e.g., CFC invests its earnings in U.S. property – U.S. real property or stock of a U.S. corporation).

For example, let’s assume that ChinaCo was profitable in year 20XX (when Mr. Wang was a U.S. green card holder), with positive earnings and profits, and it invested an additional $1 million to USCo to support its expansion in the U.S. This transaction seems just like a normal fund injection to a subsidiary for business operating purposes. However, from the U.S. tax perspective, Mr. Wang should be subject to U.S. income tax with respect to the $1 million fund injection, regardless of how the $1 million was used by USCo, or how much income it generated. Under the U.S. Subpart F income rules, the $1 Million investment should be treated as an investment in U.S. property by ChinaCo being a CFC. Therefore, the investment amount should be included by CFC’s U.S. shareholder as gross income and be subject to U.S. income tax.

Note that the Subpart F income should be taxed at unfavorable ordinary tax rates (37 percent of the highest rate). In this example, it is assumed that ChinaCo’s current earnings and profits (“E&P”) are greater than $1 million so the full amount of $1 million should be recognized as Subpart F income in the current year. If ChinaCo’s current E&P is lower than the $1 million investment, the Subpart F income recognized in the current year should be limited to the current E&P (lesser of the current E&P or the investment amount). In future years, every dollar of E&P in ChinaCo would create Subpart F income recognition until the total amount of the $1 million investment in U.S. property is reached.

Cash-flow Issues with a Sandwich Structure

Sandwich Structure is also inefficient for cash-flow purposes due to potential multi-layering of withholding tax. Assuming the same structure as Mr. Wang’s, a dividend distribution from USCo to ChinaCo should be subject to U.S. withholding tax. USCo is required to withhold 30 percent tax on the gross amount of the dividend (such withholding tax rate may be qualified for the reduced 10% rate by claiming the U.S. China income tax treaty). When ChinaCo distributes dividends to Mr. Wang, there might be another layer of Chinese withholding tax given that Mr. Wang is a U.S. tax resident. Some of the U.S. tax treaties create an even more draconian result, where if the ultimate owner of the non-U.S. company is a U.S. resident, but not a resident of the same country as the company, the U.S. withholding tax is 30 percent – the individual may no longer be able to use the treaty benefits. Each treaty has to be carefully reviewed to determine the impact of the limitation of benefits provisions.

Ways to Fix the Sandwich Structure

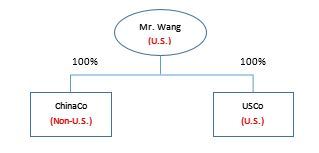

There are many alternatives to mitigate or resolve the Sandwich Structure. One alternative is to distribute USCo from ChinaCo to Mr. Wang before immigration. Such distribution may not have any U.S. income tax impact as it should be a foreign-to-foreign transfer of a capital asset. After the restructuring, it should not be a Sandwich Structure once Mr. Wang became a U.S. tax resident (see the alternative structure below).

Other alternatives are also available, such as utilizing the “check-the-box” election (i.e., by filing U.S. Form 8832 Entity Classification Election) to reclassify ChinaCo as a disregarded entity for U.S. tax purposes. Of course, further analysis is needed before making the “check-the-box” election as there are other U.S. tax implications to be considered.

It is important to note that the timing of the restructuring is very important, as the tools and alternatives to solve the Sandwich Structure are limited after the foreign investors (e.g., Mr. Wang) became U.S. tax residents. Also note that it is not necessary to obtain a U.S. green card to become a U.S. tax resident. For example, meeting the substantial presence test in the U.S. for aggregate 183 days or more might also lead a foreign investor to become a U.S. tax resident.

It is recommended to consult with a U.S. tax advisor before immigrating to the U.S. to consider various significant tax issues, which include existing U.S. investments among many other matters, which are difficult to correct once U.S. tax residency is established.

Are you a foreign investor that has found themselves in a tax sandwich?

Consulting with GHJ International Tax Team can help you resolve or mitigate the Sandwich Structure.