Generally, under the tax rules of many countries – including the U.S. – a shareholder of a corporation is not taxed until income is distributed as a dividend. This can result in a potential deferral of tax by using offshore entities located in low-taxed or no-tax jurisdictions.

The U.S. has enacted anti-deferral rules intended to change the current taxation of certain U.S. shareholders where income could be artificially shifted or otherwise made available to the shareholder. This particular set of provisions affects U.S. businesses/individuals expanding their presence overseas with outbound transactions — e.g., by acquiring or forming foreign companies (outbound) — and foreign individuals with existing companies abroad who are becoming U.S. tax residents with inbound transactions.

The Internal Revenue Code (IRC) has two principal “anti-deferral regimes” that apply to foreign corporations: a Controlled Foreign Corporation (CFC) regime and a Passive Foreign Investment Company (PFIC) regime. The provisions applying to CFCs and PFICs may impose tax on a U.S. person on a current basis when the foreign subsidiary generates income, regardless of whether any distributions are made.

This blog focuses on which entities are considered CFCs. In order to understand what a CFC is, it is important to break down how a CFC is defined.

A CFC is a foreign corporation in which U.S. shareholders own more than 50 percent of the combined total voting power of voting stock or the value of the company’s stock.

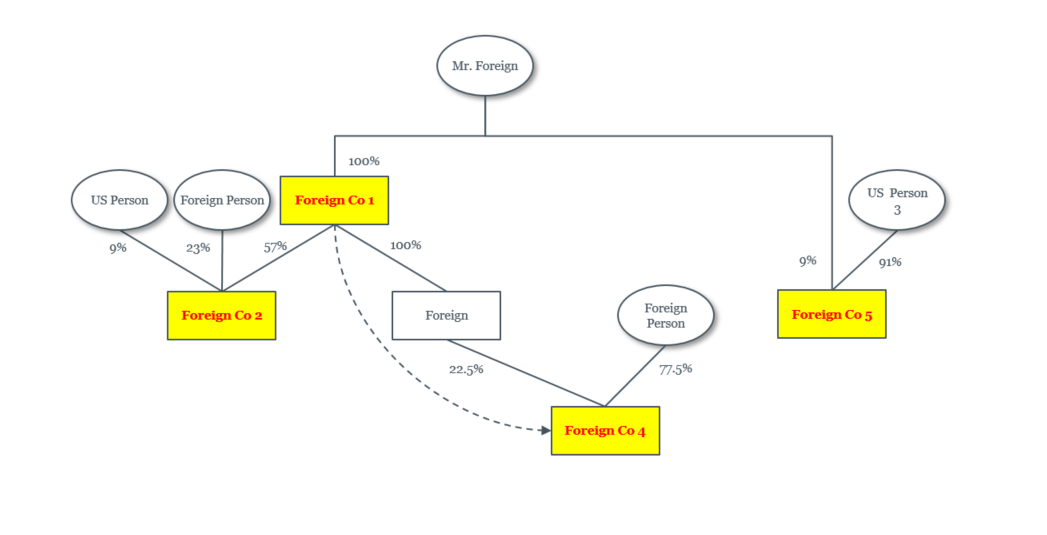

Please refer to the below organizational chart as an example.

Mr. Foreign is a foreign individual who is planning to move to the U.S. with his family in 2022. Assuming he will become a U.S. tax resident for U.S. income tax purposes, his tax advisors will have to make a determination regarding the U.S. taxation of his foreign holdings.

FOREIGN VS. DOMESTIC

A domestic entity is a legal entity organized under the laws of the U.S. or under the laws of any U.S. state. Conversely, corporations and partnerships organized under the laws of foreign countries are treated as foreign entities.

In the above example, none of Mr. Foreign’s businesses are organized in the U.S., so they would be considered foreign.

CORPORATION VS. OTHER TYPES OF ENTITIES

Determining whether or not an entity is treated as a corporation for U.S. income tax purposes involves a two-step analysis.

The regulations provide a list of “per se” corporations that are essentially comparable to C-corporations under the IRC unless otherwise specified.

Entities that are not deemed to be per se corporations are referred to as eligible entities. The next step is to determine this entity’s default classification, which depends on the number of owners and the type of liability they possess:

- An eligible entity with a single owner is treated as a disregarded entity if the owner has personal liability.

- An eligible entity with a single owner is treated as a corporation if the owner has limited liability.

- An eligible entity with more than one owner is treated as a partnership if the owners have personal liability.

- An eligible entity with more than one owner is treated as a corporation if the owners have limited liability.

The type of legal entity is determined under U.S. income tax rules. How an entity is classified for foreign tax purposes, although indicative of the type of entity it is, is not determinative.

In the example, Mr. Foreign has determined that the entities he owns are foreign corporations under U.S. tax rules. Next, he will need to determine whether the entities have any U.S. shareholders in order to determine whether they are classified as CFCs.

U.S. SHAREHOLDERS

A U.S. shareholder is, first and foremost, a U.S. person. U.S. persons are generally understood to be individuals (citizens or U.S. tax residents) or corporations but can also be partnerships, S-corporations, estates or trusts.

In order to qualify as a U.S. shareholder, a U.S. person must own 10 percent or more of the total combined voting power of all classes of stock of the foreign corporation entitled to vote or 10 percent or more of the total value of shares of all classes of stock of the foreign corporation.

Ownership is determined by including shares owned directly, indirectly (through other entities) or constructively (by attribution from certain related individuals or entities).

For instance, Mr. Foreign directly owns 9 percent of Foreign Co 5. If the other owner’s interest cannot be attributed to Mr. Foreign once he becomes Mr. Domestic, he is not considered a U.S. shareholder of Foreign Co 5 because he does not meet the 10 percent threshold.

Mr. Foreign also indirectly owns 57 percent of the stock in Foreign Co 2 through his 100 percent ownership of Foreign Co 1. Since Mr. Foreign owns at least 10 percent of the stock of Foreign Co 2, directly or indirectly, he qualifies as a U.S. shareholder.

CONTROL

The final qualification for a CFC status is that U.S. shareholders (as defined above) together own more than 50 percent of the total combined voting power of all classes of stock of the corporation entitled to vote or the total value of stock of the corporation.

Mr. Foreign owns 100 percent of Foreign Co 1. Since he owns at least 10 percent, Mr. Foreign is a U.S. shareholder of Foreign Co 1. In addition, since Mr. Foreign owns more than 50 percent of Foreign Co 1, Foreign Co 1 will be treated as a CFC once he becomes Mr. Domestic.

Mr. Foreign indirectly owns an interest of 22.5 percent in Foreign Co 4 (through his ownership of Foreign Co 1). Since ownership may be direct, indirect or constructive, Mr. Foreign is considered a U.S. shareholder of Foreign Co 4. The rest of the stock of Foreign Co 4 is owned by a foreign person who does not qualify as a U.S. person. Therefore, Foreign Co 4 is not a CFC.

HOW DOES CFC OWNERSHIP AFFECT TAXPAYERS?

So why should one be concerned with having ownership in a CFC? As mentioned above, the principal tax implication of being a U.S. shareholder of a CFC is that such a shareholder is subject to anti-deferral rules. The main anti-deferral provisions applicable to CFCs are Subpart F income and Global Intangible Low-Taxed income (GILTI).

It is crucial for taxpayers to understand which type of investments they hold so that they (or their tax advisors) can determine if they should include the earnings generated by the foreign entity in their U.S. taxable income on a current basis. Making this determination prior to becoming a U.S. tax resident might also allow for important tax planning to minimize or eliminate the impact of these rules. Individuals and entities planning expansion outside of the U.S. can also engage in tax planning by taking the impact of these rules into account and avoiding unpleasant surprises.

Separately, U.S. shareholders of a CFC are subject to certain U.S. reporting requirements, including a requirement to file Form 5471, Information Return of U.S. Persons With Respect to Certain Foreign Corporations. Form 5471 is a complex form with many schedules. Late or substantially incomplete filings are met with steep penalties and interest. Form 5471 is subject to an automatic $10,000 penalty, which can increase up to $60,000 per form. In addition to the penalties and interest, if this form is not filed or deemed to not be filed (i.e., incomplete), the statute of limitations for the IRS to examine the entire income tax return remains open.

If you are unsure of how the rules summarized above may apply to you, please reach out to GHJ’s International Tax Practice for assistance.