GHJ Transaction Advisory Principal David Sutton sits down with Partner and Advisory Practice and Transaction Advisory Practice Leader Anant Patel to discuss merger and acquisition trends, 2021 outlook and the impact COVID-19 has had on the market.

CURRENT STATE OF M&A MARKET

DAVID SUTTON: Most would date the last M&A cycle commencement back to 2010/2011 with each cycle turning over every 7-8 years. We are very much beyond that and 2019 was a record year when many market participants started to think about the end of the cycle. What do you see in this upcoming year and cycle?

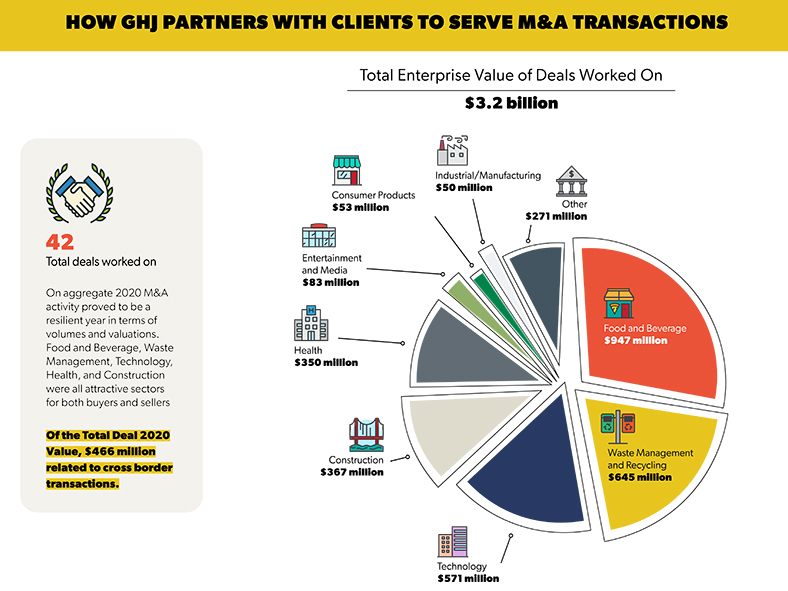

ANANT PATEL: I think the market will be ripe for M&A transactions this year. We saw a lot of growth in our practice in 2020 (see graphic below), not only in deal size, but also in the diversity of our client base. Consumer products and food and beverage are typically big players in the market, and last year we saw significant activity within the health and wellness industry as well. Businesses that adjusted through the pandemic have retained their value and there is still a lot of demand for those companies, so M&A activity remains strong. If we look at our own transaction data there is a lot of consistency in volume and valuation with 2019, which was itself a record breaking year for M&A markets.

THE IMPACT OF COVID-19 ON M&A TRANSACTIONS

DS: How has COVID-19 impacted the market for buyers and sellers?

AP: The market has adjusted fairly well in the face of the pandemic. Debt and capital markets remain strong, which can be accredited to loose regulations and safe guards set in place by banks. There is still an appetite for buyers and equally sellers who want to go to market. The buyer group is changing and Baby Boomers are looking to exit and capitalize on valuations. This speaks to a larger trend of the decline in average years of ownership. Before, companies would stay in families for multiple generations. Now, we see clients wanting to sell the asset rather than pass it down.

MIDDLE MARKET HAS STAYING POWER

DS: The Middle Market was quite resilient in 2020. What do you attribute that to?

AP: The Middle Market has really been able to take advantage of different stimulus opportunities like the Paycheck Protection Program. The availability of capital, low interest and inflation rates have provided cover for these businesses allowing them to maintain previous levels of business activity. More importantly, we have seen a huge amount of entrepreneurial spirit from middle-market business owners, navigating the pandemic and pivoting or in some cases completely reinventing their business model to maximize the opportunities in front of them. In the 2021 Middle Market Growth survey, private equity professionals are feeling bullish about 2021 and business and consumer confidence are high. The 2021 outlook for this market seems to be optimistic.

MARKET ACTIVITY PICKS UP IN THE ASIA PACIFIC

DS: From a global perspective, what changes do you foresee in the near term?

AP: A few things to note about the global market. First, the biggest target region for M&A investment is expected to shift to Asia Pacific, majority China, passing North America by the end of the year. Second, the trajectory of the vaccine (for COVID-19) is expected to increase spending and demand short term, which could be extremely favorable for consumer driven business and having a knock on effect in almost every industry. However, there are still questions surrounding travel, especially international. 2021 is looking to be a strong year for M&A transactions, but I also think the majority of deals will be domestic. We also see access to debt and other liquidity forms remaining strong, with low inflation and interest rates being contributors to overall economic growth.

If you have any question about the above content, please reach out to your business advisor or a member of GHJ’s Transactions Advisory Services Practice.