Hollywood filmmakers are continually searching for ways to promote their films to an international audience. A big focus is on China, the world’s second largest theatrical market. However, the Chinese film market seems to be particularly challenging to understand. One of the latest examples is Star Wars: The Last Jedi, which made only $42 million dollars in China box office, in sharp contrast to its worldwide box office of $1.3 billion dollars. We have also seen other cases, such as Warcraft and Resident Evil: The Final Chapter, where China can “save” a movie from its underwhelming performance in other territories.

You may ask, is China an entirely different country with a unique taste compared to the rest of the world? What makes a foreign movie successful in China?

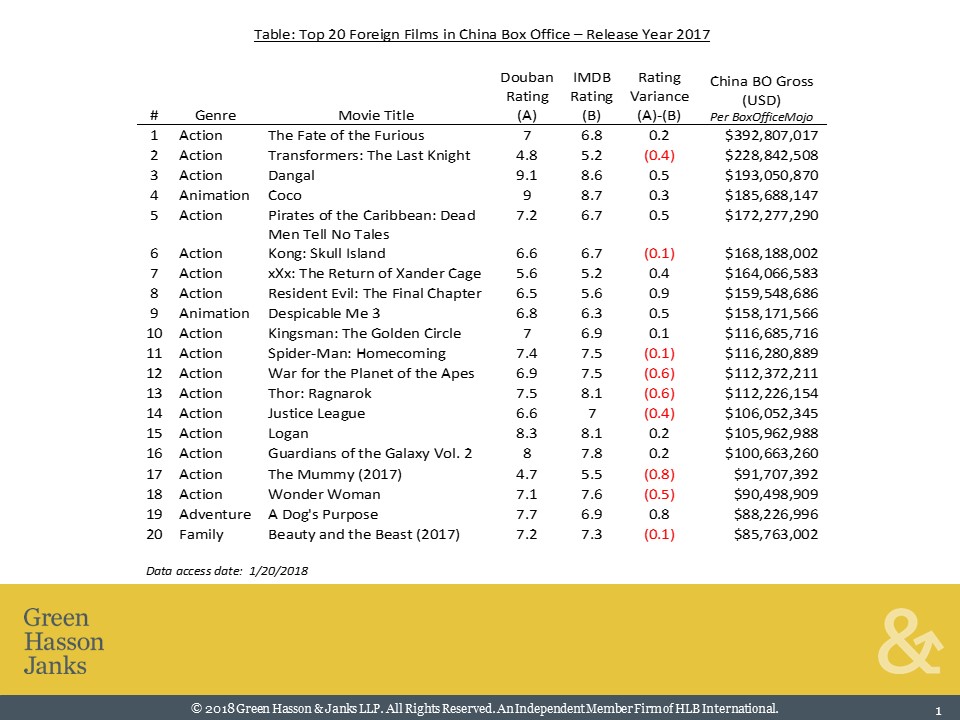

To answer these questions, let us first look at the film ratings comparison below for the top 20 foreign films in China for the year of 2017.

The film ratings data is drawn from two sources: Douban, a popular Chinese movie rating platform, and IMDB (user split approximately 20 percent U.S. and 80 percent non-U.S.), which is assumed to represent global audience ratings. The ratings data answers several quite interesting questions:

- Do action films or heavy visual effects films mean higher ratings among the Chinese?

Contrary to popular belief, compared to the global audience, the Chinese audience does not necessarily favor action and visual effect films. The analysis above includes 16 action films. Six of the 16 action films received similar ratings among Chinese and global audiences (within a 0.2 variance on a 10-point scale). Four other films are rated between 0.4 and 0.9 higher by the Chinese. The remaining six films, including big-budget titles such as The Mummy, Thor: Ragnarok and War for the Planet of the Apes, received 0.4 to 0.8 lower Chinese ratings than the global audience ratings.

- What type of films does the Chinese audience rate more favorably?

The two films that received much higher ratings among the Chinese are Resident Evil: The Final Chapter (0.9 higher) and A Dog's Purpose (0.8 higher). One of the key factors that contributed to their high ratings is the highly targeted marketing campaigns implemented by the Chinese local distributors and marketing partners. Thanks to big data resources from China’s online ticketing platforms, social media and e-commerce platforms, the promotion activities for The Final Chapter were designed to target Resident Evil’s large videogame fan base in China. Similarly, the marketing campaigns for A Dogs’ Purpose focused on pet lovers, female moviegoers and families. When the majority of the audience is already connected to the theme and the story, it is not a surprise that they give higher ratings. A similar successful story of targeted marketing strategies is the 2016 videogame based movie Warcraft (Douban rating 7.7; IMDB rating 6.9), which made $213M in China compared to $47M in the U.S.

- Do Chinese and Global moviegoers share the same favorite films?

Yes, the three highest rated movies are the same according to Chinese and global audiences: Dangal, Coco and Logan. This confirms that the best stories are universal - they can transcend age, nationality or culture. As Chinese moviegoers are becoming more sophisticated in choosing movies, word of mouth does matter - both Dangal and Coco earned more during second and third weekends than the opening weekend in China and enjoyed an extended run at the theaters.

So why do people have the misconception that Chinese moviegoers love nonstop action and visual effects without caring much about the quality? This is because we often reach the conclusion by focusing on how much these films earned at China’s box office. As is true in every movie market, financially successful films do not always get the highest ratings. Below are some factors to consider:

- Action films are easier for an audience to access than a movie with a lot of dialogue, especially when it comes to foreign language movies. Same explains the popularity of Chinese Kung-Fu movies among the western audience.

- Movie stars still have major box-office power in China. For example, xXx: Return of Xander Cage (Douban rating 5.6) has made over $160M in China’s box office, and its cast includes Vin Diesel, a familiar face to the Chinese audience thanks to the Fast & Furious franchise, Donnie Yen, a top Chinese action star who appeared in many popular Chinese films, and Krish Wu, one of the hottest Chinese rising stars with a huge following (he is also the Super Bowl LII Ambassador for NFL China).

- Release schedules makes a big difference. If Hollywood titles are going up against each other around the same time, they are simply competing for the same slice of pie. For instance, Geostorm, Blade Runner 2049 and Thor: Ragnarok were released within one week of each other (on 10/27, 10/27, 11/3 respectively), and these three titles collectively made $189M in China. In comparison, Transformers: The Last Knight, released on 6/23/2017, made over $228M in China despite the 4.8 ratings on Douban. It is worth noting that only two other Hollywood titles were in the theaters at the same time as Transformers: The Last Knight (The Mummy was released two weeks prior and Despicable Me two weeks after) and 90 percent of Transformers’ box office was generated during the first two weeks.

As we look ahead, let us not be surprised by the next Hollywood hit in China. Considering China’s enormous moviegoer base, as long as a film has a selling point that resonates with a particular audience group, combined with a favorable release schedule, it should not be difficult to achieve good results in the China box office.