ASU 2016-13 is currently effective and requires private companies and nonprofits to adopt the current expected credit loss model (CECL) this fiscal year. The extensive scope of the standard, which covers cash equivalents, accounts receivable, loans, debt securities and other financial assets, underscores the urgency for prompt evaluation and implementation to ensure compliance with U.S. GAAP.

BACKGROUND

Historically, U.S. GAAP has utilized an "incurred loss" approach for credit loss reporting, which deferred recognition until the loss became probable. During the global financial crisis of 2007 and 2008, the significant flaws in this methodology became clear. Many financial institutions could not report credit losses on collateralized mortgage obligations and mortgage default swaps, even though they were aware of the default risks since they had not met the requirements of the accounting standard. In response, the Financial Accounting Standards Board (FASB) and the International Accounting Standards Board (IASB) jointly established the Financial Crisis Advisory Group (FCAG) to identify avenues for enhancing financial reporting. The FCAG promptly identified the flaws in the incurred loss model and recommended the integration of forward-looking information.

FASB issued Accounting Standards Update (ASU) 2016-13, Financial Instruments — Credit Losses (Topic 326): Measurement of Credit Losses on Financial Instruments, on June 16, 2016. The standard is effective for private companies and nonprofits for fiscal years beginning after Dec. 15, 2022.

While financial institutions were most significantly affected by the new standard, it will continue to have a broad-reaching impact on companies across all industries that hold financial assets, including trade receivables, loans and debt securities.

THE NEW CREDIT LOSS MODEL

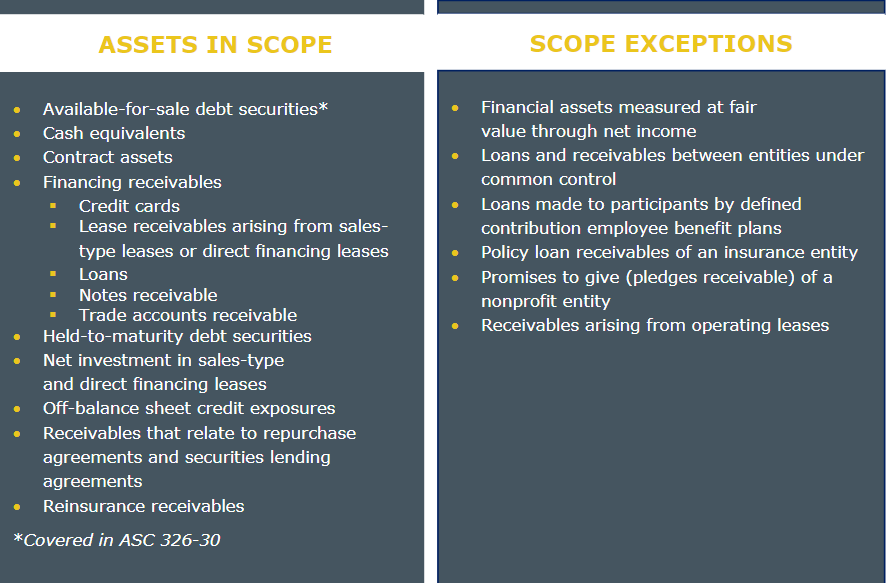

ASC 326 represents a substantial shift in how entities account for credit losses, impacting the accounting treatment for most financial assets and certain other instruments that are not measured at fair value through net income. The new model will be applied to nearly every asset measured at amortized cost and receivables with some scope exceptions.

ASC 326-20 replaces the existing “incurred loss” model with a new “current expected credit loss” (CECL) model. All the financial assets measured at amortized cost noted above, with the exception of available-for-sale debt securities, fall under this model. CECL eliminates the probable initial recognition threshold and requires entities to estimate and recognize all expected credit losses over the contractual terms for the financial assets in scope immediately when a financial asset is originated or purchased, even if the risk of loss is remote. Going forward, the allowance for credit loss will need to be remeasured at each subsequent reporting period where financials are subject to GAAP.

CECL also requires pooling financial assets for analysis based on similar risk characteristics, whereas the previous standard merely allowed for pooling. Under the new model, historical credit loss experience will form the basis for an entity’s assessment of expected credit losses. However, the new standard is clear that entities should not rely solely on past experience to estimate credit losses. Historical loss information is then adjusted for current conditions and reasonable and supportable forecasts

After calculating the historical loss rate, adjustments should be made to the extent that management expects current conditions and reasonable and supportable forecasts to differ from the conditions that existed during the period historical losses were evaluated. Entities should consider adjusting historical loss information for differences in current economic conditions as well as current asset specific risk characteristics, such as differences in underwriting standards, portfolio mix or asset terms. Entities will also need to forecast economic conditions and adjust their calculated historical loss rate based on this forecast. Forecasts must be reasonable and supportable and may utilize internal and/or external data in the analysis. Adjustments to the loss rate may be qualitative or quantitative. Entities should not make adjustments beyond the reasonable and supportable forecast period and should revert back to historical losses at that point.

This new standard requires a high degree of management judgement. There is no prescribed method for estimating expected credit losses due to the subjective nature of the estimate. However, the standard provides several examples of methods that may be utilized when calculating the historical loss rate, including discounted cash flow methods, loss-rate methods, roll-rate methods, probability-of-default methods or methods that utilize an aging schedule. Management will need to determine which method best fits their entity’s needs and determine the appropriate time period to use in the calculation. Additionally, management judgement will be used in determining which macroeconomic variables to consider when evaluating current and future economic conditions. Entities should develop estimation techniques that are applied consistently over time and should faithfully estimate the collectability of financial assets by applying the principles in the standard.

SUMMARY OF KEY CHANGES

PREVIOUS INCURRED LOSS MODEL | NEW CECL MODEL | |

RECOGNITION THRESHOLD | When probable threshold is met for loss or when incurred as of balance sheet date | Estimate and recognize all expected credit losses over the contractual terms for financial assets in scope immediately, even if risk of loss is remote |

POOLING OF ASSETS | Allowed but not required | Required |

CONSIDERATION OF ECONOMIC CONDITIONS | Consider current economic conditions only | Consider current economic conditions as well as management’s reasonable and supportable forecast of future economic conditions |

Additionally, ASC 326-30 contains a separate credit loss model that only applies to available-for-sale (AFS) debt securities and replaces the existing other-than-temporarily impaired model applied to AFS securities under legacy GAAP. Unlike the CECL model, AFS debt securities are measured at fair value as opposed to amortized cost, and the securities are evaluated on an individual basis as opposed to being subject to pooling. Entities are only required to estimate expected credit losses if the fair value of a security falls below its amortized cost basis. In which case, the allowance for credit loss would be limited by the amount by which the security’s amortized cost basis exceeds its fair value.

DISCLOSURES

Enhanced disclosures under the new standard aim to provide transparency on credit risk management, methodology and the impact on financial statements, which enables financial statement users to assess the credit quality of financial assets and understand changes in expected credit losses over time. Disclosures will be expanded both quantitatively and qualitatively.

SUMMARY

While CECL may not necessarily have a material impact on entities’ allowance for credit loss, management will be required to make new judgements and calculations to comply this this new standard. Entities should also consider if their policies and procedures should be updated to ensure the necessary data is accurately captured.

If you have any questions or want to know more, please connect with GHJ Audit and Assurance Practice for guidance and assistance in implementing this new accounting standard.