| GHJ’s Risk Management for Private Foundations Series: Navigating Challenges and Seizing Opportunities dives deep into the risks that private foundations face and offers practical solutions across a spectrum of areas including automation, cybersecurity and new giving strategies. Gain insights into implementing new ideas, ensuring compliance and exploring innovative partnerships to enhance impact. Learn more. |

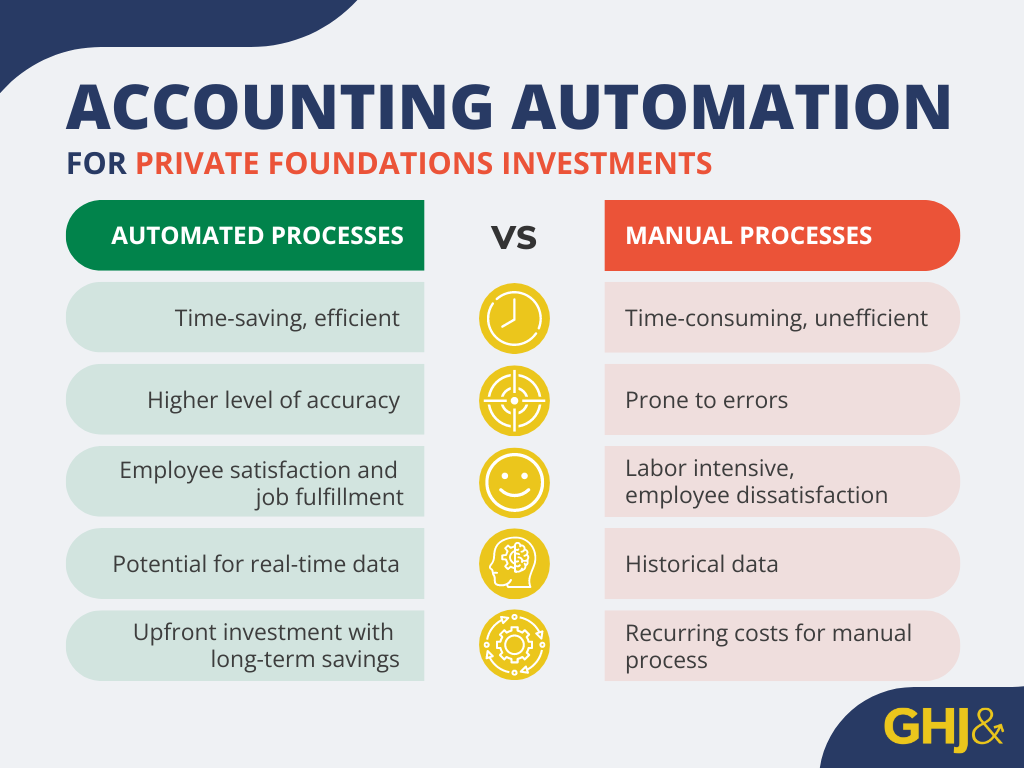

Automation may seem like an optional perk for many private foundations. By automating accounting functions, private foundations can improve data accuracy and analysis, as well as staff satisfaction and retention.

But delaying the implementation of automation can expose private foundations to several risks, including reduced staff efficiency, substandard data analysis and increased human error.

"Preparing for each stage of automation helps foundations and their Boards avoid unwelcome surprises while also creating a realistic timeline," says Cindy Bischof, GHJ Audit Manager who focuses on private foundation clients. "The Ralph M. Parsons Foundation is an industry leader in spearheading automation efforts. Other foundations can learn a lot from these efforts as a starting point for implementing their own investment automation."

CONSIDER THE BENEFITS OF AUTOMATION

Automating accounting for investments requires a significant monetary cost, so it is important to make sure that the outcomes support the level of investment.

"Although there is a significant monetary cost to implementing any sort of automation, especially something as complex as investment accounting, from our experience, the benefits outweigh those costs," says Ralph M. Parsons Foundation Director of Finance Jonathan Wald.

Foundations should evaluate both quantitative and qualitative factors for a truly comprehensive cost-benefit analysis. Calculating how many human hours would be saved with automation is an obvious starting point, but measuring subjective factors is equally important. This includes staff satisfaction, reduced staff task redundancy and increased accuracy and timeliness. Improving these metrics with automation reduces staff turnover and reputational risk caused by computational errors.

"It is important for foundations to perform a cost-benefit analysis to make sure they are investing time and money in the right places," Cindy explains. “For many private foundations interested in automation, investment accounting is the most strategic starting point.”

Investment Accounting Automation Benefits in Action

|

UNDERSTAND THE COSTS OF AUTOMATION

After estimating the expected benefits of accounting automation, the next step is to understand the time and financial investments — both of which are significant.

"While execution is an essential component of a project's success, it is the thorough planning stage that lays the foundation for this success," Jonathan says. "In my experience, allocating a significant portion of time and resources to carefully plan each aspect of a project is crucial. This comprehensive planning ensures that when we move to the execution phase, we are far more prepared and equipped to handle challenges and achieve our goals efficiently. A well-planned project often translates to a smoother execution, ultimately leading to a more successful outcome."

Here is what a private foundation can expect during the planning stages:

- Select the right software and integration partner.

- Provide information and data necessary to train the automation.

- Test the workflow and implementation.

- Provide feedback.

However, the work is not finished once the automation software is launched. Account for both financial and time-intensive investments after implementation as well. For instance, staff training is required on how to use the new system and tools. There is also continuous system maintenance needed to ensure the software continues to operate as expected.

"There comes a point where foundations realize the benefits outweigh the costs and a significant amount of staff time is freed up," Cindy says.

BEST PRACTICES FOR INTEGRATING AUTOMATION PROCESSES

Planning Stage

- Invest adequate time in researching and comparing different software options and bids from integration partners.

- Consider how the potential software works with existing systems.

- Choose the one that best suits your budget, functionality and scalability requirements.

Execution Stage

- Assign a primary person within the organization — a “champion” — who is excited about the project and has deep knowledge of the processes, to oversee the implementation.

- Manage the project and implementation partner diligently.

- Stick to timelines.

- Thoroughly test the systems before going live.

AUTOMATION IN ACTION: THE RALPH M. PARSONS FOUNDATION

Understanding the investment versus reward of automation can be a challenge for private foundations. The Ralph M. Parsons Foundation, however, is an inspiring success story.

The first stage of integrating automation was adopting machine-learning software to read investment statement PDFs and extract information to generate journal entries. This resulted in:

- 400 hours saved per year

- Improved quality, accuracy and timeliness of the Foundation's financial reports and statements

- Better and faster decision-making

- Improved optimization and analysis of their investment portfolio

Jonathan says that the Parsons Foundation is looking for more opportunities to automate its processes.

"I believe automation is the way of the future, and this is just the beginning,” Jonathan says. “It is a very exciting time to be a leader in this space because many of our manual day-to-day tasks can be automated. There are opportunities for automation and increased efficiency almost everywhere you look."