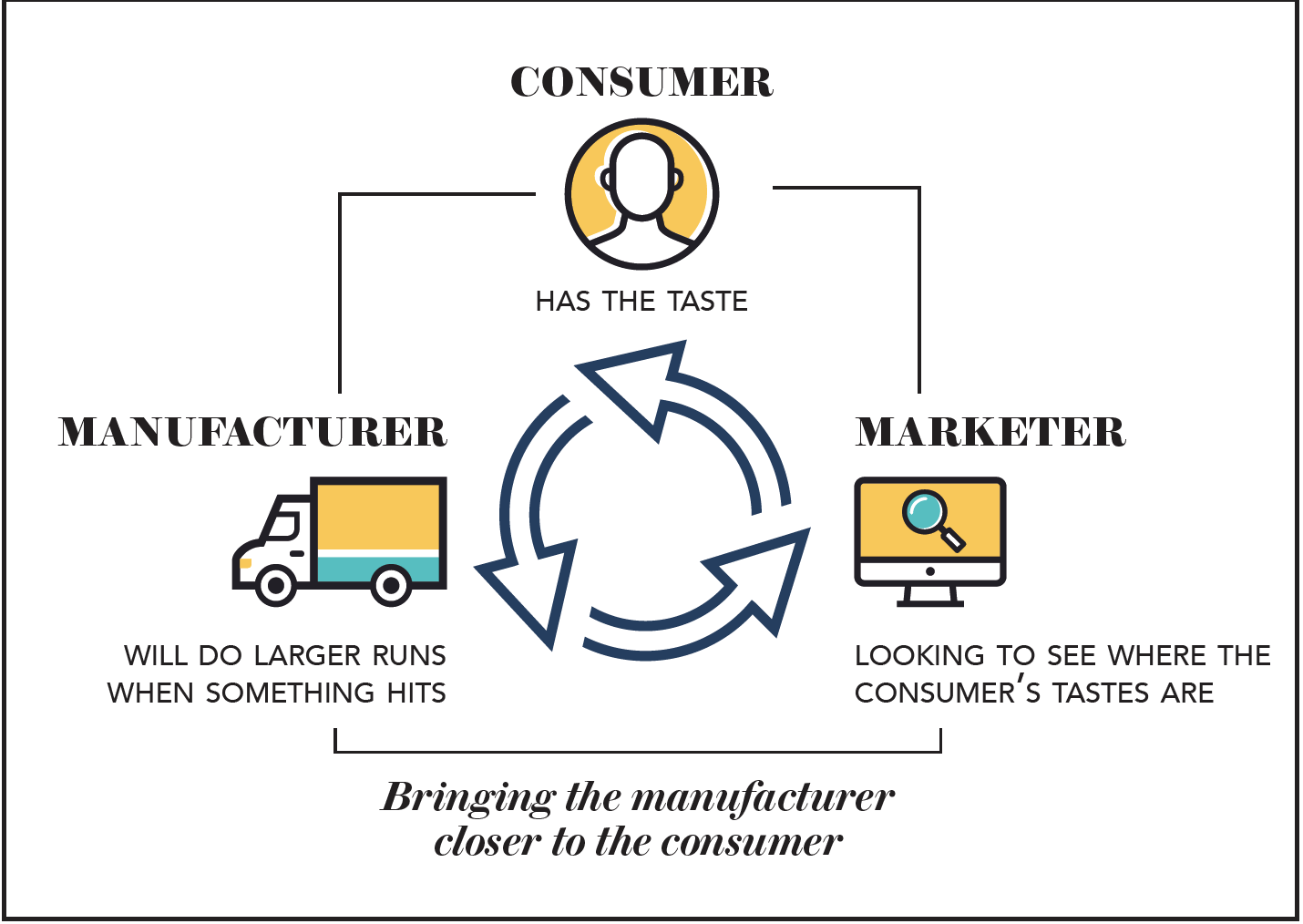

Consumer demand for new products is the primary driver for food and beverage innovation. For example, over the past few years the healthy foods moment has pushed companies to come out with products that are gluten free, organic, no preservatives and much more. Whole product lines are being created, while others are fading. Food and beverage companies that want to succeed will need to listen to their customers and continue to innovate.

Innovative companies have realized they can capitalize on customer needs if they just listen. The companies that are able to hear the customer needs are able to innovate product solutions. Those brands will have a major advantage in the marketplace.

“It started with Yelp — for good or bad,” Snyder expands. “Restaurants have had to respond to platforms that trumpet consumer opinions. On the bright side, social media gives consumers a direct line to every aspect of the food and beverage industry, and they can heavily influence new products.”

Everyone has walked into grocery stores and seen the marked increase in white labeled products, particularly in organic foods. Every chain has their own “brand” and sells multiple products under that name. Is it innovation? Certainly, the concept is, and the lower margin products can be profit centers for savvy stores.

The Amazon acquisition of Whole Foods is a game changer, but do not count out brick and mortar stores just yet, according to Donald Snyder, Partner and Head of the GHJ Food and Beverage Practice.

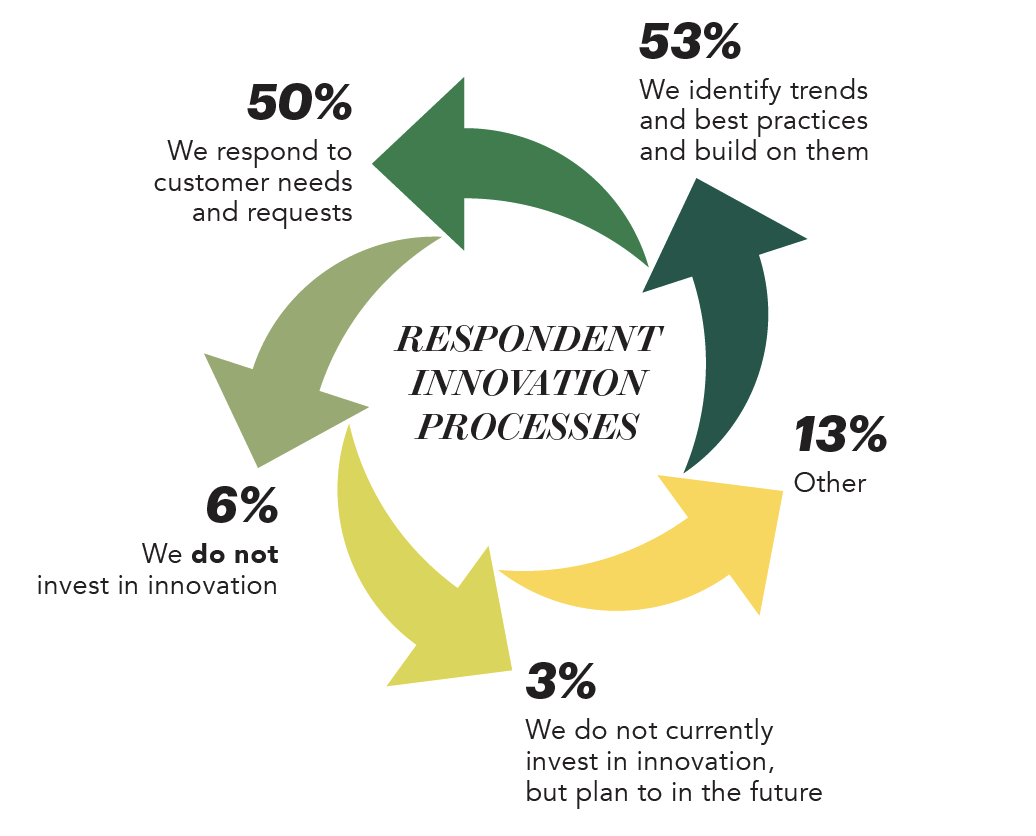

Customers are playing a major role in innovation, with 50 percent of respondents reporting that they are innovating based on customer requests. The types of changes being requested include product innovation, clean labels, variety, sustainability and sourcing.

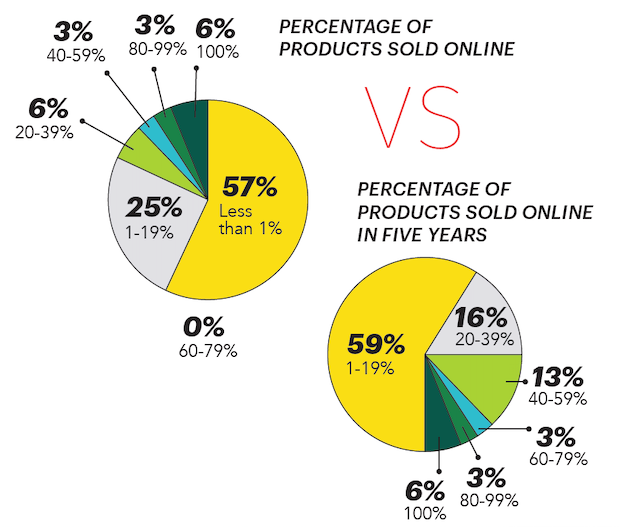

Selling products online is an interesting topic for food and beverage companies. The majority sell less than 20 percent of their products online, with 82 percent reporting they currently sell less than 20 percent of their products online. That number is expected to fall, with 59 percent saying they expect to sell less than 20 percent of their products online in five years.