For some private foundations, real estate investment partnerships can be a way to diversify an investment portfolio.

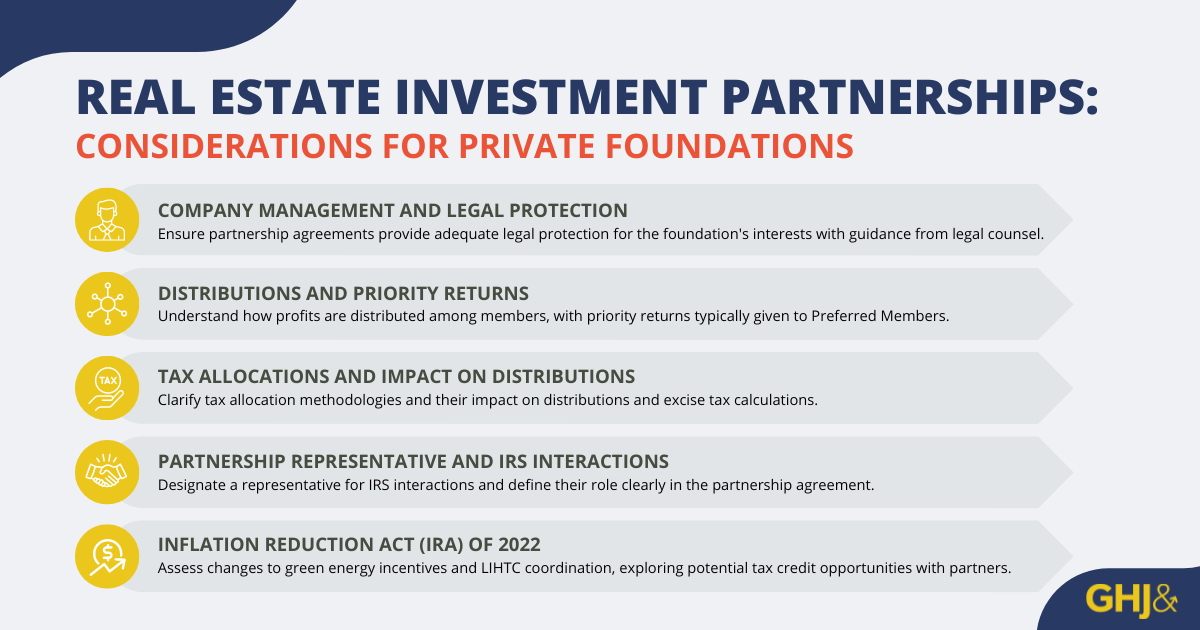

Due diligence is an important step that private foundations must take before making a direct investment in real estate. Here are the most pressing considerations that private foundations should weigh in order to mitigate risks before entering into a real estate investment partnership agreement.

COMPANY MANAGEMENT

Private foundations often create partnerships with a property manager that oversees the operation of the income-generating property, while the foundation contributes capital.

"The partnership or LLC operating agreement should be reviewed by legal counsel and should include sufficient legal protection and rights for the private foundation as the Preferred Member," explains GHJ Real Estate Practice Leader Andrew Pitt. "This provides a level of security in the event of disputes or defaulting circumstances due to the manager or the Common Member."

One of the most important categories of clauses to include is approval by the Preferred Member (the private foundation) for the following items:

- Budget

- Large capital expenditures

- Loan originations

- Acquisitions

An experienced lawyer can help private foundations draft all areas of the agreement to maximize protections.

DISTRIBUTIONS

Private foundations should pay close attention to the distribution rights from the property investment, commonly known as the "waterfall."

"The waterfall determines how operating or capital distributions are paid to the members," Pitt explains. As Preferred Members, private foundations need to be aware of what they are entitled to in the event of a capital event or from normal operations.

Agreements are generally structured so that Preferred Members are entitled to a preferred percentage return on their capital investment first, in addition to a share of the capital appreciation, before Common Members are entitled to distributions.

TAX ALLOCATIONS

A real estate investment partnership should also detail tax allocations. It is common practice in the industry to employ a “targeted capital account” or “hypothetical liquidation” for tax income/loss allocation purposes.

This methodology essentially backs into what the current year’s tax income/loss allocations should be based on a hypothetical calculation of what each member will receive in cash if all of the assets of the partnership are liquidated and sold at fair market value.

"Each member's cash distribution in this hypothetical liquidation exercise references back to the distribution clause," says Pitt. "So, it is critical that private foundations review both distributions and tax allocations together in detail, as it will have an impact on how the taxable income or loss is allocated to the private foundation and resulting excise tax calculations."

PARTNERSHIP REPRESENTATIVE

A new IRS law requires eligible partnerships to designate a Partnership Representative. In the event of an IRS examination, the Partnership Representative is responsible for interfacing with the IRS on behalf of the partnership and has the authority to make binding decisions, such as whether to accept or appeal an examination result.

The Partnership Representative role should be clearly defined in the partnership or LLC operating agreement. A Partnership Representative does not have to be a partner or member in the partnership, but once designated, it is binding for that tax year. After that, the representative can be changed from year-to-year.

In the event a Partnership Representative is not designated on the tax return, the IRS has the authority to designate one of their choosing before any examination proceedings begin.

"It is very important for the private foundation to determine whether it wants one of their employees or another contact to act as the Partnership Representative,” Pitt says. "This decision needs to be clearly defined as a separate clause in the agreement."

INFLATION REDUCTION ACT (IRA) OF 2022

The IRA made significant changes to green energy incentives and coordination with the low-income housing tax credit (LIHTC) as they apply to tax-exempt entities.

Generally, the IRA made it more beneficial for tax-exempt entities to pursue green energy incentives as part of a real estate project. The benefit comes in the form of a direct tax credit payment and entitles the organization to a refund regardless of whether the organization actually has excise tax liability.

There were also enhancements made so that green energy incentives can be added on with the LIHTC. In new real estate projects and joint ventures, it is prudent for private foundations to discuss these tax credits upfront with the developer partner.

| GHJ’s Risk Management for Private Foundations Series: Navigating Challenges and Seizing Opportunities dives deep into the risks that private foundations face and offers practical solutions across a spectrum of areas including automation, cybersecurity and new giving strategies. Gain insights into implementing new ideas, ensuring compliance and exploring innovative partnerships to enhance impact. Learn more. |