| GHJ’s Risk Management for Private Foundations Series: Navigating Challenges and Seizing Opportunities dives deep into the risks that private foundations face and offers practical solutions across a spectrum of areas including automation, cybersecurity and new giving strategies. Gain insights into implementing new ideas, ensuring compliance and exploring innovative partnerships to enhance impact. Learn more. |

One of the most important roles of a professional administrator is to ensure the foundation meets its annual minimum payout requirement. Otherwise, the foundation risks being subject to an excise tax. While many foundations opt to over-give every year, others may not meet their annual target and must catch up over the next year.

Many unforeseen events can derail the grantmaking process as year-end approaches. For instance, events such as a death in the family or a grant that falls through at the last minute could create a challenge in meeting those grant-making targets.

WHAT IS A DONOR ADVISED FUND?

A sidecar donor-advised fund (DAF) can help with both expected and unexpected challenges. Any portion of the grants budget that remains unspent in December can be granted to the DAF.

“Grants to DAFs (at least for now) count toward a foundation’s payout requirements and the funds can then be granted out over time from the DAF,” says Pegine Grayson, Director of Philanthropic Services at the Whittier Trust. “I’ve also seen families use sidecar DAFs as a pressure release valve when they are arguing over discretionary grants that may or may not map to the family’s mission. By naming the DAF something unrelated to the Foundation or family name, grants can go out anonymously, which can dramatically reduce tensions in the family."

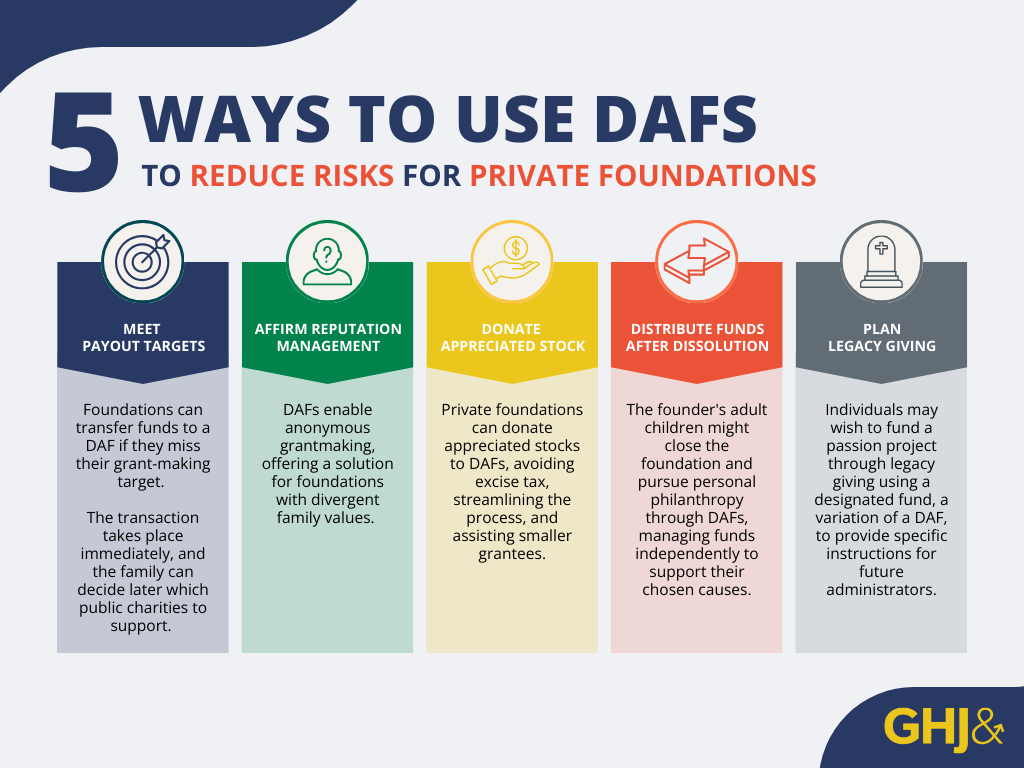

5 WAYS PRIVATE FOUNDATIONS CAN USE DAFs TO REDUCE RISK

Private foundations can use DAFs to reduce risk in several areas, from reaching payout targets to handling conflicting family values.

- Meet payout targets.

Foundations can move funds into the DAF if they cannot make their grant-making target by the deadline. The transaction date applies immediately, and the family can later make decisions about which grants to recommend from the DAF. - Resolve conflicting family values and affirm reputation management.

Grayson notes that foundations with multiple family members may have opposing values. In these instances, a DAF can be used to donate discretionary funds. It is a form of anonymous grantmaking so family members can donate to opposing ideas without impacting the reputation of the foundation. - Donate appreciated stock.

Private foundations seeking to avoid paying the 1.39% excise tax on investment income can contribute appreciated stock to their DAF. This can be a simpler solution than making multiple stock transfers to individual grantees, especially because smaller grantees may not have brokerage accounts to accept the transfers. The shares are sold within the DAF, which then pays the grantee by check.

Part of the Internal Revenue Service Priority Guidance Plan for fiscal year 2023 is to issue final regulations on Donor Advised Funds. "DAF rules could change in the future," Grayson cautions, “so it’s important to keep an eye on the policy front.” - Distribute foundation funds after dissolution.

Family foundations with a board of several adult kids of the founder may be ready to shut down the foundation and start their own philanthropic endeavors. Opening a DAF is a simple solution that allows each of them to receive a portion of the funds and distribute them to causes they care about on their own schedules. - Endow a grantee in perpetuity with a designated fund.

Some individuals may have a passion project they want to fund through legacy giving after they pass away.

"A designated fund (a variation of a DAF) can support a specific nonprofit indefinitely, pursuant to written instructions for the administrator to carry out in the future," Grayson says.

DAFs IN ACTION: GHJ FOUNDATION

GHJ has been philanthropic since its inception but launched GHJ Foundation in 2020 to formalize those efforts. It makes two grant cycles per year and draws from employee volunteers to create grants committees (nine members per cycle).

"One of the goals of launching GHJ Foundation was to be more purposeful, proactive and transparent with our philanthropic giving," says Donella Wilson, President and Chief Philanthropy Officer of GHJ Foundation.

But Donella noted that the Foundation must work to proactively engage employees in a way that makes sense based on the firm's growth.

For GHJ, the firm was initially L.A.-based. But now, GHJ has grown to over 250 employees across nearly 30 states. As a result, the term "community" has a much broader definition.

"We are looking for ways to engage with the expanded geographies of our people," says Wilson.

In 2023, GHJ Foundation launched a partnership with Groundswell, an enterprise philanthropy-as-a-service platform to democratize and decentralize corporate philanthropy.

"We want to make sure our employees can support whatever organizations they want with a certain amount of confidentiality," Donella explained. "Groundswell aligns with GHJ's commitment to equity and inclusion and democratizes engagement."

Employees research nonprofits and make contributions through the Groundswell app. When employees add funds to their Groundswell account (which operated as a DAF), this triggers a matching gift from GHJ Foundation.