INTRODUCTION

For many decades in Hollywood, studios producing television series have been generally consistent with:

- How they distribute television series;

- How they share profits with stakeholders through contingent compensation (modified adjusted gross receipts, or MAGR); and

- How they share information about the success of the series.

Distribution of a series has had an exclusive window for the initial network exhibition. However, the studio would eventually exploit distribution through third-party licensing.

Profit sharing, which has been based on agreements with production partners and the talent, by design, intended to provide for a sharing of the ”upside” when television series becomes a success (e.g., Friends, Seinfeld and many more).

Finally, transparency by studios through the sharing of audience data has been part of the norm in the industry.

This ecosystem has advantages and disadvantages, though it has been a sustainable model for decades in Hollywood… until streaming came to life.

The streaming giants attempted to change it all by maintaining content exclusively into perpetuity, using (sometimes overpriced) buyout and cost-plus deals to essentially eliminate profit sharing with others while not sharing any streaming metrics to provide partners and talent a measure of success for their shows.

The drive to get more subscribers required significant investment in producing programs regardless of the bottom-line impact. So long as Wall Street focused on growing the streaming service subscriber base, there was no pushback.

More recently, investors began to question the financial sustainability of streaming services, which requires streaming services to rethink their approach, including the possibility of going back to a model Hollywood is familiar with from its past: third-party distribution, equitable sharing of profits with stakeholders and sharing information about the success of its programs.

As there is an ongoing debate in the motion picture and television industry as to what path to forge into the future, GHJ’s Profit Participation Services Team developed a report that could contribute to the ongoing discussions.

OVERVIEW AND ASSUMPTIONS

The team developed a model of the net participation of a producer of a fictional popular miniseries (named “Everyone Wins”) made for streaming.

This report includes two major components to what is deemed to be the “network receipts:” an allocation of a streamer’s gross revenue from subscription video-on-demand (SVOD) and advertising video-on-demand (AVOD) fees. Furthermore, presuming that the streamer exploits third-party licensing of the series beyond the initial network exhibition on its streaming platform with the same intensity as a studio, third-party licensing revenues and costs were estimated based on GHJ’s industry experience.

A sample participation statement (statement) of the producer’s net participation (similar to a MAGR statement) was created using these two components (“network receipts” and third-party licensing).

For this model, the streamer funded all production costs, plus a 5-percent producer overhead fee, of which both are recouped on the statement, plus interest. Additionally, the initial exclusivity period for the series on the streamer’s platform is assumed to be two years from the exhibition of the last episode. After the two-year exclusive window, the streamer will be able to license the series to other third-party licensees and other markets. The sample statement is calculated on a cumulative basis from the initial quarter that the series was released to four years post that initial exhibition.

Most importantly, this model assumes and depends on the streamer’s willingness to share revenue and viewership data with its financial partners, producers and talent.

STREAMING ALLOCATION METHODOLOGY AND ASSUMPTIONS/ESTIMATES

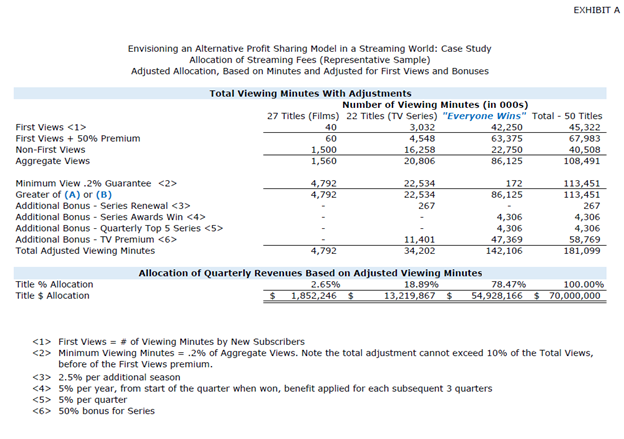

As it relates to the allocation of the streamer’s quarterly SVOD and AVOD revenues, it is assumed that at the very least, the series is among the top 100 titles on the streamer’s platform (based on the number of views). This sample estimates an allocation of 50 products, which is intended to be representative of thousands of titles on the platform. For the 50 titles included in this sample, the streamer’s quarterly revenues from SVOD and AVOD fees were estimated to be $70 million. The viewing minutes used in the allocation of the streaming revenues have already been weighted for domestic (U.S.) and foreign adjustments.

The allocation of the total quarterly streamer’s revenues is mostly based on viewing minutes of the title, with various adjustments to the allocation relating to factors, such as the type of viewing minutes and product. For example, a premium of 50 percent was added to those “First Views Minutes,” which represent the minutes that relate to new subscribers who watch a certain title immediately after signing up for the platform, indicating that the title generated new subscribers. Additionally, a 0.2-percent minimum allocation value was included so each title in the allocation at least earns a 0.2-percent allocation based on the unadjusted total viewing minutes.

Further, we have included various bonuses relating to series that have been renewed beyond one season, bonuses for awards and bonuses for being in the top-five among all titles, per quarter, on the platform. It is assumed the series only has one season (i.e., a miniseries), earned one award and was in the top-five spot for one quarter (its initial release quarter).

Finally, a premium (50 percent of adjusted minutes) was added for television product, versus film product, as television product is typically considered more valuable on a streaming platform. After all of the adjustments, the series earns a 78.47 percent allocation of the total quarterly streaming revenues for its initial quarter release, or $54,928,166.

Based on this initial allocation, and assuming the total quarterly receipts remain consistent in totality for the 50 titles, the value of the series for subsequent quarters was estimated through the end of the fourth year after its initial exhibition using diminishing value per quarter. Using this methodology, the allocation portion for the series of the streamer’s streaming (network) revenues is estimated to be $172,769,427 cumulatively at the end of four years after the initial release. See Exhibit A below for further details on how streaming revenues were derived for the series.

CONTINGENT COMPENSATION MODEL (STATEMENT)

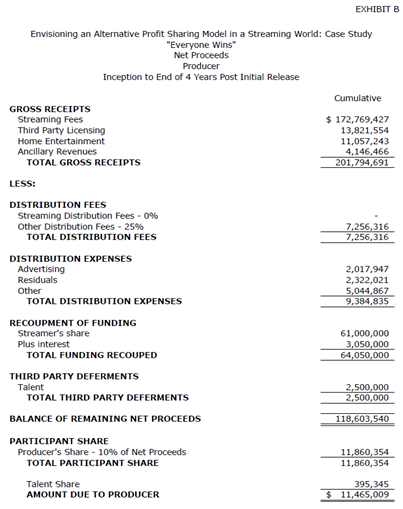

This model used various assumptions based on GHJ’s industry expertise to create a simulated profit-sharing statement (See Exhibit B below), issued by the streamer to the producer, which may be used as a starting point for streamers and participants to discuss a more equitable way for streamers, producers and other stakeholders to share in the success of titles.

The gross receipts reported on the statement include the “network receipts”, or the allocated streaming revenues described above, plus additional revenues from third-party television licensing, home entertainment and ancillary markets. These additional revenues are estimated as a percentage of the allocated streaming revenues, using percentages based on GHJ’s industry experience. The statement also includes a 25-percent distribution fee, calculated on all gross receipts except streaming revenues (as network receipts are customarily not subject to fees). The distribution expenses are presented as a percentage of related revenues, estimated based on GHJ’s industry experience.

As noted above, the series has one season (10 episodes), and production costs are estimated to be six million dollars per episode. The cost per episode is assumed to be net of any applicable tax credits.

Additionally, in the model, the talent has agreed to defer two million dollars of their compensation (recouped on the backend) in exchange for a $500,000 guaranteed bonus (payable after the initial exhibition of the series), plus their calculated pro-rata share (3.33 percent, calculated as $2 million divided by $60 million) of remaining proceeds from the producer’s share.

The total streamer costs to be recouped amounted to $61 million, calculated as net production costs, plus guaranteed 5-percent overhead to the producer, less the $2 million talent deferments.

Interest is calculated at 5 percent per year, and production costs are estimated to have recouped within the first year; therefore, only one year of interest is charged. Additionally, the negotiated backend percentage points to the producer is 10 percent.

Using the above assumptions and estimates, the producer share of net proceeds is $11,465,009. The talent’s share (after their deferment and guaranteed bonus are earned) is $395,345, and the studio retains $106,743,186 of net proceeds.

COMPARISON TO COST-PLUS MODEL AND CONCLUSION

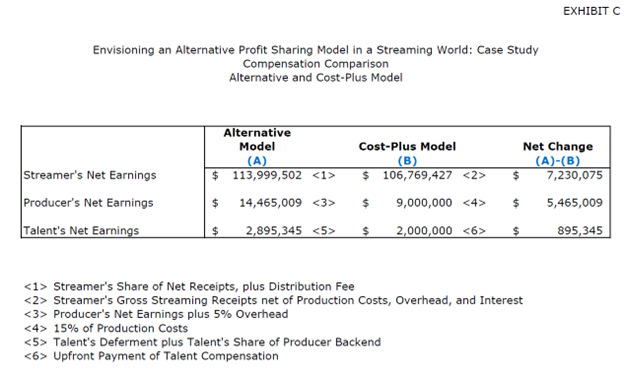

The direct-to-streaming model typically includes a cost-plus model, where the streamer pays the producer the cost of production for the title, plus a premium on that total cost. The premium varies between projects and streamers and based on GHJ’s industry experience, is estimated to be 15 percent.

The cost-plus model provides a guaranteed return to the producer; however, this does not allow the producer (or talent) to participate in the success of the title. Therefore, the new model described above provides an alternative solution to allow for the talent/producers/co-financers to participate in the success of a title, while the streamer still earns its monthly subscriber fees and can generate additional revenues from third-party licensing.

The new model presumes the streamer moves away from the lengthy exclusive window to the more traditional studio model, through which it looks to third-party licensing. See Exhibit C below for a comparison between the cost-plus model and the new alternative model.

At a high level and in summary, here is how our proposed accommodations would impact each key stakeholder in this model :

PROPOSED ACCOMODATION |

POTENTIAL BENEFIT |

|

STREAMER |

|

|

PRODUCER |

|

|

TALENT |

|

|

SENSITIVITY ANALYSIS

Based on GHJ’s sensitivity analyses, the estimate that impacted the analysis the most was the streamer’s estimated quarterly total revenues for the 50 titles included in the allocation. Thus, the higher the number of subscribers and advertising revenue, the higher the ultimate share of the profits among all stakeholders.

Under this model, if the streamer generates at least $50 million in the initial release quarter of this series and similar amounts for subsequent quarters (for the 50 titles), the series will break even. Anything above this amount will generate additional revenues, and both the streamer and producer will participate in the profits.

SUMMARY

While there is no guarantee that any television series will be successful, GHJ’s goal in sharing this report is to show a possible path for streaming services to consider, through which everyone involved could benefit when a program becomes an enormous success. This does require a shift in the streaming business model to be more transparent, embrace third-party licensing and have more equitable sharing of successful programs.

GHJ’s team involved in creating this report included Ilan Haimoff, Tracy Liang, Grace Guenon, Michael Sippel and Brion Dennis. Special thanks go to others who have shared guidance and support, including Loyola Marymount University Associate Professor of Finance Dr. David Offenberg, Participant SVP Film Finance and Business Operations James Roiz and Paradigm Talent Agency Head of Business Affairs and General Counsel Craig Wagner.

To learn more about this paper, please reach out to GHJ Profit Participation Services Practice Leader Ilan Haimoff

or learn more about GHJ’s Profit Participation Services Practice.